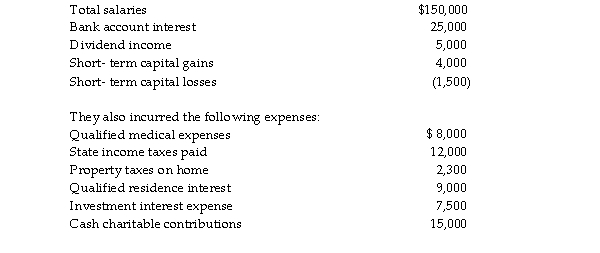

During 2018, Richard and Denisa, who are married and have two dependent children, have the following incom losses:  Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Definitions:

Owner's Equity

The residual interest in the assets of a company after deducting its liabilities; also known as shareholders' equity.

Liabilities

Financial obligations owed by a business to others, such as loans, accounts payable, and mortgages.

Total Assets

The sum of all current and non-current assets owned by a company, reflecting its overall value.

Supplies

Items used in the daily operations of a business, such as office or cleaning supplies, that are essential but not directly tied to the production of goods.

Q129: A taxpayer owns a cottage at the

Q161: Olivia, a single taxpayer, has AGI of

Q368: One of the requirements that must be

Q609: Shaunda has AGI of $90,000 and owns

Q1062: A sole proprietor contributes to the election

Q1370: Commuting to and from a job location

Q1697: Jan has been assigned to the Rome

Q1736: Steve and Marian purchase a new condominium

Q1852: Partnerships and S corporations must classify their

Q1997: Charlie owns activity B which was considered