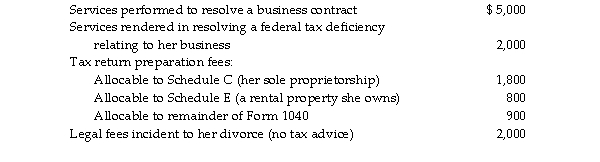

During the current year, Lucy, who has a sole proprietorship, pays legal and accounting fees for the following:  What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

Matching Concept

An accounting principle that requires the expenses to be matched with the revenues they helped to generate in the same accounting period.

Cash Is Received

The acquisition of monetary funds through various means, such as sales, financing, or donations.

Accrued

Refers to amounts that are recognized in the financial statements before the cash transactions occur, representing liabilities for goods and services received but not yet paid.

Routine Entry

Repeated and standard accounting entries made for recurring transactions within a business's financial records.

Q154: Larry had a great time in school

Q159: Empire Corporation purchased an office building for

Q188: Kickbacks and bribes paid to federal officials

Q197: When an individual taxpayer has NSTCL and

Q666: To be considered a Section 1202 gain,

Q743: If a taxpayer disposes of an interest

Q1226: An individual makes substantial cash contributions to

Q1878: RollerQueens Inc., a calendar- year accrual method

Q1934: Expenses relating to a hobby, limited to

Q2104: Taxpayers may deduct lobbying expenses incurred to