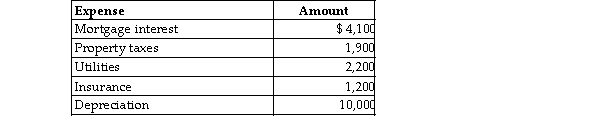

Abby owns a condominium in the Great Smokey Mountains. During the year, Abby uses the condo a total of 21 days. The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500. Abby incurs the following expenses:  Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the property will be

Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the property will be

Definitions:

Periodic Inventory System

An inventory accounting system where updates are made on a periodic basis, not continuously.

Discounts Lost

Represents the extra amount paid by a buyer above the early payment discount price, due to missing the discount period.

Partial Payment

A payment that is made towards a debt or invoice that is less than the full amount owed at the time of payment.

Installment Payments

Payments made regularly over time to settle a debt, rather than paying the full amount at once.

Q14: Name one advantage and one disadvantage of

Q15: What factors are considered in determining whether

Q690: A review of the 2018 tax file

Q963: A taxpayer sells a patent on a

Q980: A closely held C corporation's passive losses

Q1024: In order for a taxpayer to deduct

Q1301: Chance Corporation began operating a new retail

Q1355: A net operating loss (NOL) occurs when

Q1531: In determining whether a worker is considered

Q2059: Diane, a successful accountant with an annual