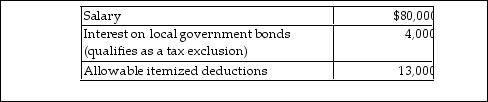

A single taxpayer provided the following information for 2018:  What is taxable income?

What is taxable income?

Definitions:

Substantially Equal

Describes items or quantities that are nearly identical in value, size, or importance, within a reasonable degree of variation.

Implied Employment Contracts

These are employment agreements not explicitly stated but inferred from actions, circumstances, or oral statements by the employer or employee, suggesting a mutual understanding or expectation regarding the employment relationship.

Reasonable Expectations

A legal standard used to assess what an average person might anticipate in a given set of circumstances.

ADA

Americans with Disabilities Act; a civil rights law that prohibits discrimination against individuals with disabilities in all areas of public life.

Q294: The basis of a partnership interest is

Q384: Distributions from corporations to the shareholders in

Q570: Pursuant to a complete liquidation, Southern Electric

Q831: Depreciation recapture does not apply to a

Q916: In a Sec. 351 transfer, the corporation

Q945: Accelerated death benefits from a life insurance

Q975: Jing, who is single, paid educational expenses

Q1094: Tax planning is not an integral part

Q1139: Elise, age 20, is a full- time

Q1318: Lance transferred land having a $180,000 FMV