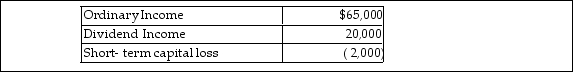

Bryan Corporation, an S corporation since its organization, is owned entirely by Mr. Bryan. The corporation uses calendar year as its taxable year. Mr. Bryan paid $120,000 for his Bryan stock when the corporation was formed o January 1 of this year. For this year, Bryan Corporation reported the following results:  Distributions of $40,000 were made during the year. What is the basis of Mr. Bryan's stock on December 31?

Distributions of $40,000 were made during the year. What is the basis of Mr. Bryan's stock on December 31?

Definitions:

Internal Revenue Code

A comprehensive set of tax laws created by the Internal Revenue Service (IRS) governing federal tax obligations.

Legislative Regulations

Laws and rules established by government legislative bodies that dictate certain behaviors or actions within society or specific industries.

Senate Finance Committee

A key committee in the United States Senate that handles legislation relating to taxes, tariffs, and other revenue-raising measures.

House Ways and Means Committee

A powerful committee of the United States House of Representatives responsible for taxation, tariffs, and other fiscal policies.

Q150: Assuming a calendar tax year and the

Q374: Assume a taxpayer projects that his total

Q774: Sheryl is a single taxpayer with a

Q1011: Lily had the following income and losses

Q1081: Ten years ago Finn Corporation formed a

Q1347: According to the Statements on Standards for

Q1397: Ray is starting a new business and

Q1711: A corporation sold a warehouse during the

Q1731: Margo and Jonah have two children, ages

Q1916: Although a partner's distributive share of income,