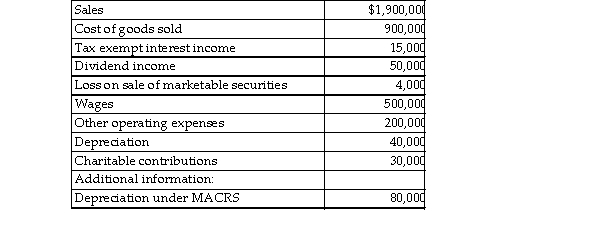

Bartlett Corporation, a U.S. manufacturer, reports the following results in its financial accounting records:  The dividend income is from very minor holdings in U.S. stocks. Calculate Bartlett's taxable income, income tax and any carryovers generated.

The dividend income is from very minor holdings in U.S. stocks. Calculate Bartlett's taxable income, income tax and any carryovers generated.

Definitions:

Relationship

A connection, association, or involvement between two or more parties, often characterized by mutual dealings or emotional bonds.

Negotiating

The process of discussing something with someone in order to reach an agreement or compromise.

Job's Salary

The amount of money or compensation that an employee receives from an employer in exchange for their labor, typically expressed as an annual figure or hourly wage.

Benefits

The advantages or positive outcomes that result from an action, policy, or product.

Q62: The requirement to file a tax return

Q112: A single taxpayer provided the following information

Q194: An electrician completes a rewiring job and

Q346: Ms. Walter, age 70, is thinking about

Q567: When appreciated property is transferred at death,

Q1022: During the year, Jim incurs $500,000 of

Q1252: Montrose Corporation is classified as a personal

Q2091: Gains and losses from involuntary conversions of

Q2110: On April 5, 2018, Joan contributes business

Q2232: Discuss actions a taxpayer can take if