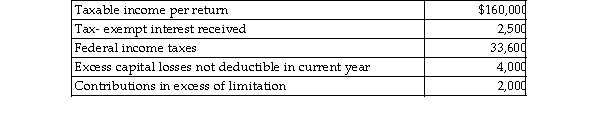

Greg Corporation, an accrual method taxpayer, had accumulated earnings and profits of $300,000 as of Decembe year. For its current tax year, Greg's books and records reflect the following:  Based on the above, what is the amount of Greg Corporation's current earnings and profits for this year?

Based on the above, what is the amount of Greg Corporation's current earnings and profits for this year?

Definitions:

Q137: Mark receives a nonliquidating distribution of $10,000

Q164: For purposes of the accumulated earnings tax,

Q338: Buzz is a successful college basketball coach.

Q613: Taxpayers must pay the disputed tax prior

Q1150: If a principal residence is sold before

Q1568: Discuss the basis rules of property received

Q1592: Rocky owns The Palms Apartments. During the

Q1594: Discuss how the partnership form of organization

Q1900: If partners having a majority interest in

Q1941: S status can be elected if shareholders