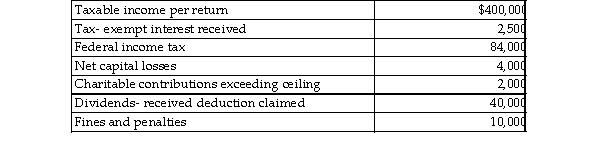

The books and records of Finton Corporation, an accrual method taxpayer, reflect the following:  Based on the above, what is the amount of Greg Corporation's current earnings and profits for this year?

Based on the above, what is the amount of Greg Corporation's current earnings and profits for this year?

Definitions:

Venue

The geographic location in which a case is tried or a legal matter is to be decided.

Court

A governmental institution authorized to resolve legal disputes and administer justice in civil, criminal, and administrative matters.

Jurisdiction

The legal power or authority given to a court or other legal body to hear and decide cases.

Federal Courts

Courts established by the federal government of a country, having jurisdiction over questions of federal law and involving interstate matters or parties.

Q31: A partner in a partnership will deduct

Q365: Aamir has $25,000 of net Sec. 1231

Q589: Pierce has a $16,000 Sec. 1231 loss,

Q1000: Rolf exchanges an office building worth $150,000

Q1073: A corporation is owned 70% by Jones

Q1270: Why does a researcher use a citator?<br>A)

Q1580: Taxpayers often have to decide between contributing

Q1801: Kole owns a warehouse used in his

Q1968: Does Title 26 contain statutory provisions dealing

Q2150: A married taxpayer may file as head