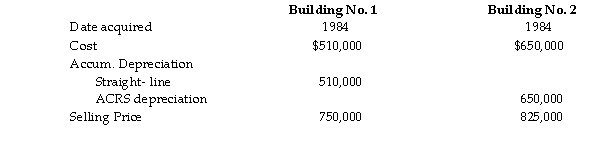

An unincorporated business sold two warehouses during the current year. The straight- line depreciation metho was used for Building No. 1 and the accelerated method (ACRS) was used for Building No. 2. Information about buildings is presented below.  How much gain from these sales should be reported as Sec. 1231 gain and ordinary income due to depreciation recapture?

How much gain from these sales should be reported as Sec. 1231 gain and ordinary income due to depreciation recapture?

Definitions:

Registration Statement

A document filed with the SEC that contains detailed information about a company's operations and securities it intends to offer.

Malpractice

A failure of a professional to meet the standard of care or conduct in their field, often leading to harm or loss.

Negligence

A lack of acting with the diligence an average reasonable person would show under the same conditions.

Professional

A person engaged in a specified activity as one's main occupation rather than as an amateur.

Q74: Which corporations are required to file a

Q164: For purposes of the accumulated earnings tax,

Q317: Emily owns land for investment purposes that

Q769: When new tax legislation is being considered

Q1476: When gain is recognized on an involuntary

Q1554: A taxpayer may elect to defer recognition

Q1718: Gifts made during a taxpayer's lifetime may

Q1830: Gain recognized on the sale or exchange

Q2032: A corporation incurs a net operating loss

Q2170: A taxpayer will be ineligible for the