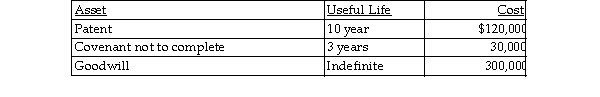

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million. Included in the assets acquired are the following intangible assets:  What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Definitions:

Purely Competitive Labor Market

A resource market in which many firms compete with one another in hiring a specific kind of labor, numerous equally qualified workers supply that labor, and no one controls the market wage rate.

Rate of Unionization

The percentage of workers who are members of a union within a particular workforce or industry.

Protective Service Workers

Individuals employed in occupations that focus on public safety, law enforcement, and security services.

Job Turnover

The rate at which employees leave a workforce and are replaced by new employees.

Q27: The WE Partnership reports the following items

Q43: Identify which of the following statements is

Q86: Cardinal and Bluebird Corporations both use a

Q95: Does the contribution of services to a

Q180: Which of the following taxes is proportional?<br>A)

Q356: A sole proprietor exchanges an office building

Q471: The IRS must pay interest on<br>A) tax

Q995: Pam, a single taxpayer, owns a building

Q1057: Shaquille buys new cars for five of

Q1085: Jack purchases land which he plans on