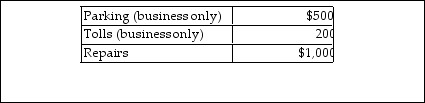

Chelsea, who is self- employed, drove her automobile a total of 20,000 business miles in 2018. This represents ab 75% of the auto's use. She has receipts as follows:  Chelsea uses the standard mileage rate method. She can deduct

Chelsea uses the standard mileage rate method. She can deduct

Definitions:

Utilities Possibilities Frontier

A graphical representation showing the maximum amount of two or more goods or services that can be produced given a set of resources, highlighting the trade-offs and opportunity costs.

Equity

Fairness or justice in the way people are treated or how resources are distributed.

Efficiency

The optimal use of resources to achieve the desired outcome with minimal waste or expense, often associated with productivity and economic contexts.

Welfare Economics

The branch of economics that focuses on the optimal allocation of resources and goods and how the allocation affects social welfare.

Q51: H (age 50) and W (age 48)

Q54: A method used to study sensation and

Q107: Itemized deductions are deductions for AGI.

Q152: The zygote first begins rapid cell division

Q186: Rachel is in the first period of

Q257: Capital expenditures incurred for medical purposes which

Q1014: Various criteria will disqualify the deduction of

Q1302: 2020 Enterprises, owned by Xio who also

Q1840: During the current year, Deborah Baronne, a

Q1944: In- home office expenses are deductible if