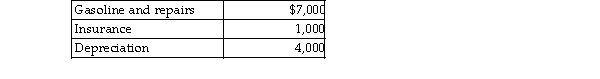

Rajiv, a self- employed consultant, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,00 commuting and personal use. The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What Rajiv's deduction for the use of the auto?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What Rajiv's deduction for the use of the auto?

Definitions:

Proprietary Fund Types

Funds used by a government to account for activities similar to those found in the private sector, where the determination of net income is necessary or useful.

Fund Financial Statements

Financial reports specifically prepared to show the financial position and results of operations for governmental funds and non-profit organizations.

Special Revenue Fund

A fund used by governments to account for revenue sources that are restricted or committed to expenditure for specified purposes other than debt service or capital projects.

Decrease in Financial Resources

A reduction in the amount of money, assets, or other financial means available to an individual or organization.

Q9: Wanda's doctor says she needs a maternal

Q42: Describe the effect of alcohol on pregnancy.

Q77: If you subscribe to Paul Baltes's perspective

Q140: Long before infants speak recognizable words, they

Q184: Shannon's son was born early and weighed

Q190: Dr. Pamarti is studying breast cancer by

Q199: What is joint attention? Describe how it

Q898: Which of the following statements is incorrect

Q1226: An individual makes substantial cash contributions to

Q1609: Daniel has accepted a new job and