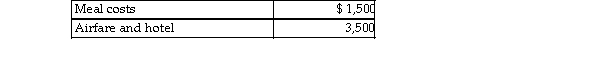

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be att by many potential customers. During the week of the convention, Steven incurs the following costs in attending conference and taking potential customers to lunch and dinner to discuss book sales.  Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

Definitions:

Chronic Low Self-Esteem

A long-standing and pervasive sense of negative self-worth or inadequacy, which affects an individual's overall mental health and quality of life.

Defensive Coping

A psychological strategy where an individual handles stress and threats by unconsciously denying or distorting reality.

Powerlessness

A state of feeling unable to control, influence, or effectively act in a situation, often leading to frustration and vulnerability.

Acute Mania

A phase of bipolar disorder characterized by an elevated mood, overactivity, rapid speech, and impulsive behavior.

Q29: Stella wants to give her baby the

Q82: These theories describe development as primarily unconscious

Q158: Any agent that can potentially cause a

Q180: In 2013, records showed a 34% increase

Q190: Why did Congress establish Health Savings Accounts

Q803: Camellia, an accountant, accepts a new job

Q1112: Last year, Abby loaned her friend, Pat,

Q1250: Erin, a single taxpayer, has 1,000 shares

Q1285: Which of the following factors is important

Q2130: For the years 2014 through 2018 (inclusive)