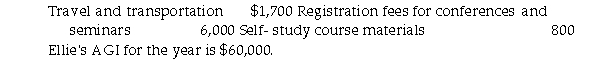

Ellie, a CPA, incurred the following deductible education expenses to maintain or improve her skills:  a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?

a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?

b. If, instead, Ellie is an employee who is not reimbursed by her employer, what are the amount of and the nat the deduction for these expenses (after limitations)?

Definitions:

Grief Work Model

A psychological framework that outlines the processes individuals go through to cope with the loss of a loved one, emphasizing emotional processing and adjustment.

Widow

A term for a woman whose spouse has died and who has not remarried.

Deceased Husband

Deceased Husband refers to a husband who has passed away, often leaving a significant emotional and sometimes financial void in the lives of their spouses and families.

Readjusting

The process of adapting or reorienting oneself to a new situation, condition, or environment.

Q81: Which of the following is a feature

Q85: The longitudinal method of research consists of

Q143: This is a special way that children

Q148: Wren is four weeks pregnant. Which of

Q170: Short segments of DNA that are located

Q298: Monte inherited 1,000 shares of Corporation Zero

Q404: A qualified pension plan requires that employer-

Q438: An employer contributing to a qualified retirement

Q1149: Generally, Section 267 requires that the deduction

Q1255: The total worthlessness of a security generally