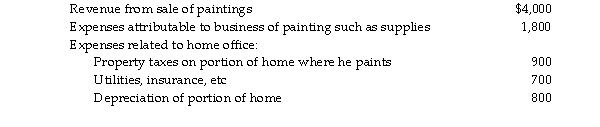

Dighi, an artist, uses a room in his home (250 square feet) as a studio exclusively to paint. The studio meets the requirements for a home office deduction. (Painting is considered his trade or business.) The following informati appears in Dighi's records:  a. What is the amount of Dighi's home office deduction if he is self- employed?

a. What is the amount of Dighi's home office deduction if he is self- employed?

b. If some amount is not allowed under the tax law, how is the disallowed amount treated?

c. Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill. How muc home office deduction, if any, will he be allowed?

Definitions:

Import Quotas

Government-imposed limits on the volume of specific goods that can be imported, aimed at protecting domestic producers by controlling market supply.

Globalization

The integration of national economies into a worldwide economy.

American Consumer

An individual in the United States who purchases goods and services for personal use.

Frederic Bastiat

A 19th-century French economist and writer known for his advocacy of free trade and his witty criticisms of protectionism and socialism.

Q39: Gwendolyn is having a prenatal test where

Q43: Joseph was born with the potential to

Q64: Behavioral and social cognitive theories emphasize:<br>A) unconscious

Q113: On July 1 of the current year,

Q121: The theory that was created by Erik

Q195: What is the difference between a gamete

Q753: Tess has started a new part- time

Q1349: Jeffrey, a T.V. news anchor, is concerned

Q1743: Discuss the tax treatment of a nonqualified

Q1963: Josh purchases a personal residence for $278,000