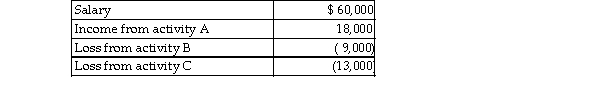

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attrib activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable ga What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attrib activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable ga What is Nancy's AGI as a result of these transactions?

Definitions:

Big Bluestem Grass

A tall North American prairie grass that is a dominant species in the Great Plains, known for its nutrient-rich forage.

Abiotic Components

Non-living chemical and physical parts of the environment that affect living organisms.

Biotic

Term that indicates life; a cell is an example of a biotic factor in the environment.

Energy Flow

The movement of energy through a food chain or ecosystem, typically from the sun through producers to consumers and finally to decomposers.

Q51: The cultural makeup of the U.S. population

Q74: In Bandura's most recent model of learning

Q157: Doris donated a diamond brooch recently appraised

Q404: A qualified pension plan requires that employer-

Q639: Which statement is correct regarding SIMPLE retirement

Q791: Hui pays self- employment tax on her

Q893: Don's records contain the following information: 1.

Q1324: A taxpayer's home in California is destroyed

Q1343: Punitive damages are taxable unless they are

Q2104: Taxpayers may deduct lobbying expenses incurred to