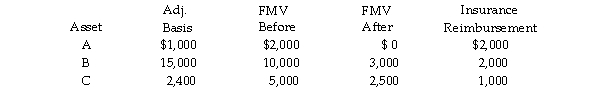

Wes owned a business which was destroyed by fire in May 2018. Details of his losses follow:  His AGI without consideration of the casualty is $45,000. What is Wes's net casualty loss deduction for 2018?

His AGI without consideration of the casualty is $45,000. What is Wes's net casualty loss deduction for 2018?

Definitions:

GDP Deflator

A measure of the price level calculated as the ratio of nominal GDP to real GDP times 100

Consumer Price Index

A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, typically used as an indicator of inflation.

Inflation

The economic condition characterized by a general increase in prices and fall in the purchasing value of money over time.

Base Year

A specific year against which economic indices are measured or compared, allowing for the assessment of economic performance or inflation.

Q127: Cynthia is conducting a survey on the

Q140: In a common law state, jointly owned

Q170: Short segments of DNA that are located

Q222: A taxpayer's rental activities will be considered

Q699: Jordan paid $30,000 for equipment two years

Q898: Which of the following statements is incorrect

Q1038: Richard exchanges a building with a basis

Q1475: In 2000, Michael purchased land for $100,000.

Q1706: A taxpayer can deduct a casualty loss

Q1997: Charlie owns activity B which was considered