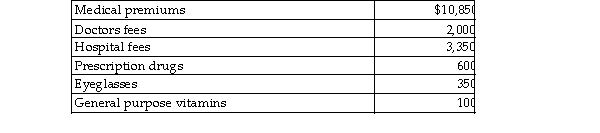

Mitzi's 2018 medical expenses include the following:  Mitzi's AGI for the year is $33,000. She is single and age 49. None of the medical costs are reimbursed by insuran considering the AGI floor, Mitzi's medical expense deduction is

Mitzi's AGI for the year is $33,000. She is single and age 49. None of the medical costs are reimbursed by insuran considering the AGI floor, Mitzi's medical expense deduction is

Definitions:

Subrogation

The legal right of a third party, usually an insurance company, to pursue recovery of amounts paid for a claim from a liable party.

Federal Statute

A law enacted by the national government that applies across the whole country.

Uniform Commercial Code

A comprehensive set of laws governing commercial transactions in the United States, aimed at standardizing laws across states.

Sale of Goods

A transaction in which ownership of physical products is transferred from a seller to a buyer for payment.

Q25: Generally, expenses incurred in an investment activity

Q415: Each year a taxpayer must include in

Q511: Martina, who has been employed by the

Q708: The sale of inventory at a loss

Q1287: Taxpayers who own mutual funds recognize their

Q1338: Corporate taxpayers may offset capital losses only

Q1380: Distinguish between the accrual- method taxpayer and

Q1422: Unlike an individual taxpayer, the corporate taxpayer

Q1695: On July 25, 2017, Karen gives stock

Q1743: Discuss the tax treatment of a nonqualified