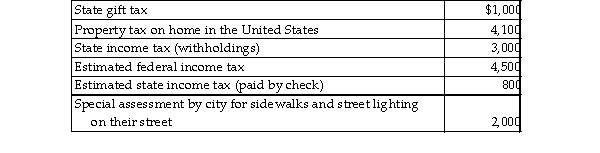

During the year Jason and Kristi, cash- basis taxpayers, paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in current year?

Definitions:

Revenue

The total amount of money received by a company for goods sold or services provided during a certain period of time.

Formula

A mathematical equation or rule expressed in symbols, often used in scientific, mathematical, or financial calculations.

Variable Overhead Efficiency Variance

The difference between actual variable overhead and the standard cost, reflecting efficiency in using resources that vary with production volume.

July

The seventh month of the year in the Gregorian calendar, often associated with the peak of summer in the Northern Hemisphere.

Q34: Expenditures incurred in removing structural barriers in

Q192: When she was a child, Anna's home

Q503: A taxpayer purchased an asset for $50,000

Q648: Discuss what circumstances must be met for

Q650: Caleb's 2018 medical expenses before reimbursement for

Q979: If a loan has been made to

Q1133: Bret carries a $200,000 insurance policy on

Q1348: Jamal, age 52, is a human resources

Q1833: The key distinguishing factor for classifying a

Q2143: Shane, a partner in a law firm,