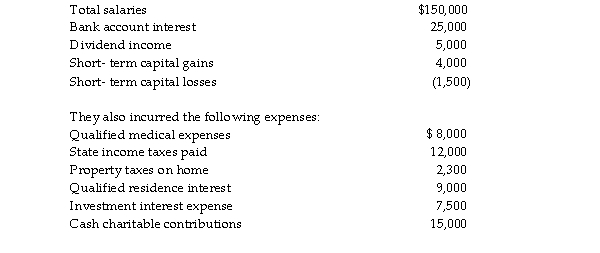

During 2018, Richard and Denisa, who are married and have two dependent children, have the following incom losses:  Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Definitions:

Economic Trends

Patterns or movements in economic indicators such as GDP, unemployment rates, or consumer confidence that indicate the general direction of an economy.

Taxation Depreciation

The allowance for the depreciation of assets that can be deducted from taxable income for tax purposes.

Accounting Depreciation

Accounting depreciation is the systematic allocation of the cost of a tangible asset over its useful life, reflecting its consumption, wear and tear, or obsolescence.

After-Tax Consequences

The financial results of an event or transaction taking into account the effects of taxes.

Q114: Which theory BEST explains changes in cognitive

Q152: Tyler has rented a house from Camarah

Q643: The tax law encourages certain forms of

Q751: What type of property should be transferred

Q1363: Employees receiving nonqualified stock options recognize ordinary

Q1405: Ahmad's employer pays $10,000 in tuition this

Q1522: Frasier and Marcella, husband and wife, file

Q1735: Investment interest expense is deductible when incurred

Q1957: Beth and Bob are married entrepreneurs. Beth

Q2223: For non- cash charitable donations, an appraisal