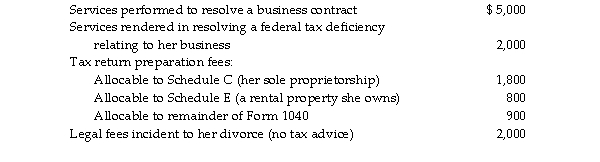

During the current year, Lucy, who has a sole proprietorship, pays legal and accounting fees for the following:  What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

EI

This is an abbreviation for Existential Import, which suggests that for a proposition to be true, the entities mentioned in it must actually exist.

DM

Direct Message; a private form of communication between social media users.

Justification

The action of showing something to be right or reasonable, providing support or evidence for beliefs or actions.

Simp

A slang term, often derogatory, used to describe someone who is overly sympathetic or attentive towards someone else, typically without reciprocation.

Q121: Takesha paid $13,000 of investment interest expense

Q145: Except as otherwise provided, gross income means

Q152: Tyler has rented a house from Camarah

Q160: Piaget's stages are age related, distinct, and

Q164: Explain eclectic theoretical orientation. What is the

Q707: Stock purchased on December 15, 2017, which

Q1038: Richard exchanges a building with a basis

Q1116: Terra Corp. purchased a new enterprise software

Q1287: Taxpayers who own mutual funds recognize their

Q1643: Johanna is single and self- employed as