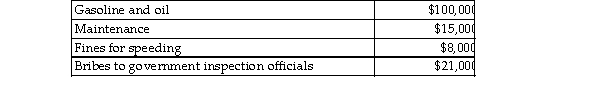

Jimmy owns a trucking business. During the current year he incurred the following:  The fines for speeding were a necessary cost because missing deadlines would cause lost business and are ordina industry. What is the total amount of deductible expenses?

The fines for speeding were a necessary cost because missing deadlines would cause lost business and are ordina industry. What is the total amount of deductible expenses?

Definitions:

Color Blind

A condition characterized by the inability to see colors in the usual way, affecting the perception of colors.

Humans

Members of the species Homo sapiens, characterized by their ability to use complex language, reason, and create complex social structures.

Color Blind

A condition in which a person is unable to distinguish certain colors or sees colors differently due to a lack of one or more types of color receptors in the eyes.

Species

A group of living organisms consisting of similar individuals capable of exchanging genes or interbreeding.

Q152: Tyler has rented a house from Camarah

Q257: Capital expenditures incurred for medical purposes which

Q260: Meals may be excluded from an employee's

Q975: Jing, who is single, paid educational expenses

Q982: The discharge of certain student loans is

Q1507: Max sold the following capital assets this

Q1533: Points paid to refinance a mortgage on

Q1692: A small corporation selling goods would prefer

Q1724: Carl filed his tax return, properly claiming

Q1725: Expenditures for long- term care insurance premiums