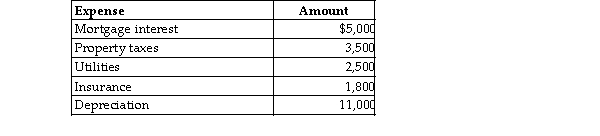

Mackensie owns a condominium in the Rocky Mountains. During the year, Mackensie uses the condo a total of 23 days. The condo is also rented to tourists for a total of 77 days and generates rental income of $10,900. Mackensie incurs the following expenses in the condo:  Using the court's method of allocating expenses, the amount of depreciation that Mackensie may take with respe the rental property will be

Using the court's method of allocating expenses, the amount of depreciation that Mackensie may take with respe the rental property will be

Definitions:

Cost of Selling Goods

The total expense directly incurred from the production or purchase of items sold by a business.

Cost of Goods Sold

An expense recorded on the income statement that reflects the total cost of producing or purchasing the goods that a company has sold during a specific period.

Cost of Goods Sold

Represents the total cost of all goods that were sold over a specific period, including the costs associated with production or purchase.

Gross Profit

The difference between revenue and the cost of goods sold (COGS), indicating the efficiency of a company in using its labor and supplies.

Q389: Vera has a key supplier for her

Q409: Rachel, a self- employed business consultant, has

Q675: Erin's records reflect the following information: 1.

Q737: Jorge contributes $35,000 to his church and

Q745: Exter Company is experiencing financial difficulties. It

Q1293: During 2018 a company provides free meals

Q1389: The wherewithal- to- pay concept provides that

Q1543: Adam purchased 1,000 shares of Airco Inc.

Q1628: Raoul sells household items on an Internet

Q1643: Johanna is single and self- employed as