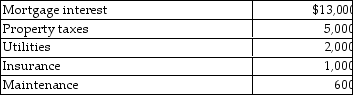

Ola owns a cottage at the beach. She and her family use the property for 30 days during the summer season and to unrelated parties for 60 days. The rental receipts amount to $8,000. Total costs of operating the property are as follows:  In addition, potential depreciation expense is $9,000.

In addition, potential depreciation expense is $9,000.

a. Is the cottage subject to the vacation home rental limitations of IRC Sec. 280A?

b. How much of expenses can Ola deduct?

Definitions:

Equivalent Unit

A method used in process costing that converts partially completed units into a number of fully completed units.

Process Costing

A costing method used in industries where production is continuous, allocating costs to products based on the processes or departments they pass through.

FIFO Method

An inventory valuation method where the first items acquired are the first ones sold, standing for "First In, First Out."

Circuit Prep Department

A specific division within a manufacturing or processing facility focused on preparing components for assembly or processing circuits.

Q12: Mickey has a rare blood type and

Q258: Linda had a swimming pool constructed at

Q373: A taxpayer goes out of town to

Q496: Donald sells stock with an adjusted basis

Q601: Benefits covered by Section 132 which may

Q622: Losses on the sale of property between

Q1028: Atkon Corporation acquired 90% of the stock

Q1378: Luly will report $800,000 of taxable income

Q1825: During 2017, Christiana's employer withheld $1,500 from

Q2037: Under the cash method of accounting, income