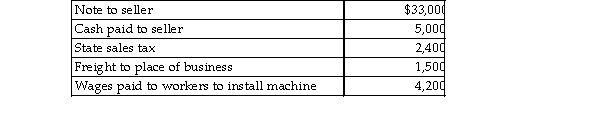

Mr. Dennis purchased a machine for use in his business. Mr. Dennis' costs in connection with this purchase were follows:  What is the amount of Mr. Dennis' basis in the machine?

What is the amount of Mr. Dennis' basis in the machine?

Definitions:

Admission of New Partners

The process of integrating a new individual or entity as a partner into an existing partnership, subject to the partnership agreement and applicable laws.

Share of the Profits

The portion of a company's profits allocated to each share of stock, or to an individual or entity as part of an agreement.

Partner

An individual or entity who shares ownership in a business partnership, jointly sharing profits, losses, and management responsibilities.

Damages

Compensation claimed by or awarded to a party for a loss or injury caused by the actions of another.

Q161: Olivia, a single taxpayer, has AGI of

Q296: Funds borrowed and used to pay for

Q638: Which of the following items will result

Q690: A review of the 2018 tax file

Q901: All of the following items are deductions

Q1024: In order for a taxpayer to deduct

Q1344: Gabby owns and operates a part- time

Q1467: Kate subdivides land held as an investment

Q1688: Gwen's marginal tax bracket is 24%. Under

Q2115: On January 31 of this year, Jennifer