Multiple Choice

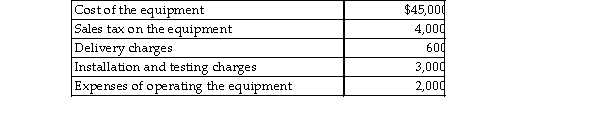

During the current year, Tony purchased new car wash equipment for use in his service station business. Tony's connection with the new equipment this year were as follows:  What is Tony's basis in the car wash equipment?

What is Tony's basis in the car wash equipment?

Definitions:

Related Questions

Q73: Wilson Corporation granted an incentive stock option

Q121: Takesha paid $13,000 of investment interest expense

Q155: Cafeteria plans are valuable to employers because<br>A)

Q291: All of the following items are deductions

Q324: Phoebe's AGI for the current year is

Q536: Bart owns 100% of the stock of

Q791: Hui pays self- employment tax on her

Q801: Parents often wish to shift income to

Q931: Sally divorced her husband three years ago

Q1260: Many exclusions exist due to the benevolence