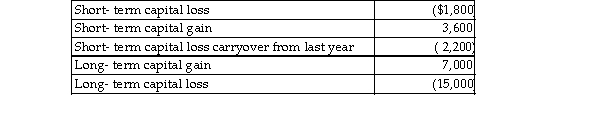

During the current year, Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year, and what is the amount and character of he loss carryover?

What is the amount of her capital loss deduction for the current year, and what is the amount and character of he loss carryover?

Definitions:

Range Slipout

A condition where a transmission unexpectedly slips out of a selected drive range into neutral or another range, often due to mechanical failure.

Leaking Air Hose

A condition where an air hose has developed breaches, resulting in the unintended escape of air, potentially affecting the performance of pneumatic systems.

COE Truck Chassis

A type of truck design where the cab is situated over the engine, offering better visibility and maneuverability.

Q163: A taxpayer in the 25% marginal tax

Q301: Discuss tax planning considerations which a taxpayer

Q494: Self- employed individuals may claim, as a

Q496: Donald sells stock with an adjusted basis

Q510: Michelle, age 20, is a full- time

Q722: On August 1 of this year, Sharon,

Q963: A taxpayer sells a patent on a

Q1030: Erik purchased qualified small business corporation stock

Q1654: A child credit is a partially refundable

Q2084: Tonya's employer pays the full premium on