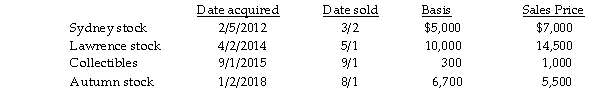

Chen had the following capital asset transactions during 2018:  What is the adjusted net capital gain or loss and the related tax due to the above transactions, assuming Chen ha marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions, assuming Chen ha marginal tax rate?

Definitions:

Frustration

An emotional response to opposition, related to anger and disappointment, that arises from the perceived resistance to the fulfillment of an individual's will or goal.

Speed Dates

short, timed interactions typically used in dating to allow individuals to meet and quickly assess mutual interest or compatibility.

Future Contact

The anticipation or arrangement of an interaction or meeting that will occur at a later date.

Social Script

A guide or schema for behavior in specific social situations, indicating the appropriate sequences of events and actions.

Q45: During the current year, Ivan begins construction

Q297: If an individual taxpayer's net long- term

Q340: Javier incurred a $40,000 net operating loss

Q474: Stacy, who is married and sole shareholder

Q943: Healthwise Ambulance requires its employees to be

Q1389: The wherewithal- to- pay concept provides that

Q1542: Which of the following bonds do not

Q1683: Doug, a self- employed consultant, has been

Q1697: Jan has been assigned to the Rome

Q1891: Property settlements made incident to a divorce