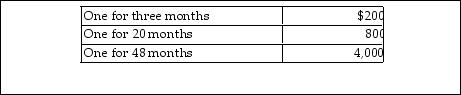

CT Computer Corporation, a cash- basis taxpayer, sells service contracts on the computers it sells. At the beginni January of this year, CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

Definitions:

Frederick Jackson Turner

An American historian known for his "Frontier Thesis," which argued that the American democracy was largely formed by the American frontier.

Western Frontier

The geographical area of the United States west of the Mississippi River during the 19th century, known for its exploration, settlement, and expansion.

John C. Frémont

An American explorer, military officer, and politician known for his role in the U.S. expansion and the Bear Flag Revolt during the Mexican-American War.

"The Pathfinder"

A novel by James Fenimore Cooper, part of the Leatherstocking Tales, or alternatively a nickname for John C. Frémont, an American explorer, military officer, and politician.

Q165: Which one of the following does not

Q239: Earl invests $7,000 in a tax- exempt

Q431: Elisa sued her former employer for discrimination.

Q557: The source of funds used to pay

Q838: Toni owns a gourmet dog treat shop

Q1301: Chance Corporation began operating a new retail

Q1535: This year, Jonathan sold some qualified small

Q1763: Sandy and Larry each have a 50%

Q1991: Parents must provide more than half the

Q2193: An S corporation can have both voting