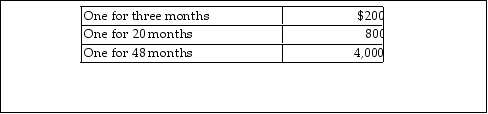

CT Computer Corporation, an accrual- basis taxpayer, sells service contracts on the computers it sells. At the beginning of January of this year, CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

Definitions:

Misleading Statement

Any declaration or representation that has the potential to deceive or misinform others, especially in contexts like advertising or public statements.

Corporate Securities

Financial instruments issued by corporations, including stocks and bonds, representing ownership or debt obligations.

Issue Securities

The process by which corporations, governments, or other entities raise capital by distributing financial instruments, including stocks and bonds, to investors.

Issues Opinions

Refers to the practice of legal bodies or officials, like courts, issuing formal judgments or explanations for their decisions on cases.

Q7: In evaluating whether to convert a current

Q119: Ben, age 67, and Karla, age 58,

Q150: Assuming a calendar tax year and the

Q514: For purposes of the dependency criteria, a

Q551: Ben is a well- known professional football

Q907: DAD Partnership has one corporate partner, Domino

Q937: Corporations may be taxed on less than

Q1003: Discuss whether a C corporation, a partnership,

Q1262: An individual is considered terminally ill for

Q1550: Kelly is age 23 and a full-