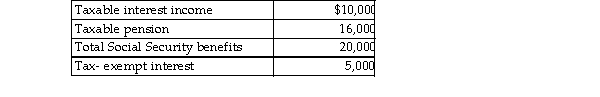

Mr. & Mrs. Tsayong are both over 66 years of age and are filing a joint return. Their income this year consisted of following:  They did not have any adjustments to income. What amount of Mr. & Mrs. Tsayongs Social Security benefits is t this year?

They did not have any adjustments to income. What amount of Mr. & Mrs. Tsayongs Social Security benefits is t this year?

Definitions:

Accrued Product Warranty Costs

Costs that have been incurred but not yet paid for product warranties, recognized as liabilities on the balance sheet.

Enacted Tax Rates

The legally approved rates of taxation set by governmental authorities.

Pre-Tax Book Income

Income of a business before the deduction of tax expenses as reported in the financial statements, not necessarily reflective of taxable income.

Depreciation Expense

An accounting method that allocates the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Q264: Which of the following is not required

Q364: Speak Corporation, a calendar- year, accrual- basis

Q528: Bridget owns 200 shares of common stock

Q718: On January 1 of this year, Brad

Q1230: Norah, who gives music lessons, is a

Q1237: In the case of foreign- earned income,

Q1313: The Current Model most closely describes a

Q1338: Corporate taxpayers may offset capital losses only

Q1346: David has been diagnosed with cancer and

Q1594: Discuss how the partnership form of organization