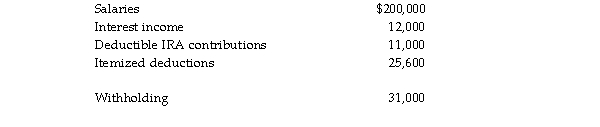

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2018 Bob and Brenda are age 32 and have no dependents.  a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax), rounded to the nearest dollar?

e. What is the amount of their tax due or (refund due)?

Definitions:

Rule 10b-5

A regulation under the Securities Exchange Act of 1934 prohibiting any act or omission resulting in fraud or deceit in connection with the purchase or sale of any security.

1933 Securities Act

A federal statute enacted to govern the offer and sale of securities, aiming to ensure transparency and fairness in the securities market by requiring disclosures through registration of securities.

Material Fact

A crucial piece of information that can affect the outcome of a legal decision or the valuation of an investment.

Section 5

Often refers to a specific section of a larger act or law, needing explicit context, such as Section 5 of the Federal Trade Commission Act related to unfair or deceptive acts or practices.

Q172: Oliver receives a nonliquidating distribution of land

Q287: Nondiscrimination requirements do not apply to working

Q680: Ms. Marple's books and records for 2018

Q697: Generally, deductions for (not from) adjusted gross

Q1481: Which of the following constitutes constructive receipt

Q1565: Mia is a 50% partner in a

Q1764: Peter transfers an office building into a

Q1795: Jamahl and Indira are married and live

Q2162: Rich, an individual investor, lives in a

Q2199: Insurance proceeds received because of the destruction