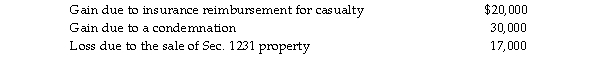

The following are gains and losses recognized in 2018 on Ann's business assets that were held for more than one The assets qualify as Sec. 1231 property.  A summary of Ann's net Sec. 1231 gains and losses for the previous five- year period is as follows:

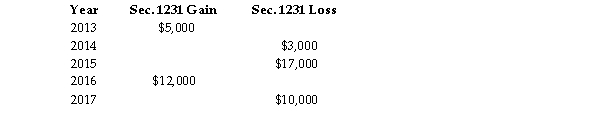

A summary of Ann's net Sec. 1231 gains and losses for the previous five- year period is as follows:  Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

On-the-job Training

A method of professional development where employees acquire skills and knowledge during the course of their regular work activities, often under the guidance of experienced colleagues.

Vestibule Training

A training method where employees are trained in a separate space (a 'vestibule') using the equipment and tools that they will use in their actual work, but within a simulated work environment.

Work-based Program

An educational or training program that combines work experience with learning activities, often aimed at improving employability.

Big Five Personality

A theory describing five broad dimensions of human personality traits: openness, conscientiousness, extraversion, agreeableness, and neuroticism.

Q196: DEF Corporation and MNO Corporation are both

Q685: Rocky and Charlie form RC Partnership as

Q706: Ava has net earnings from self- employment

Q899: In 2018, Modern Construction Company entered into

Q1019: Whaler Corporation makes a liquidating distribution of

Q1026: The number appearing immediately following the decimal

Q1225: On June 1, 2015, Buffalo Corporation purchased

Q1234: Discuss whether a C corporation or a

Q1306: An individual taxpayer who is self- employed

Q1872: Kenrick is sole proprietor of K Enterprises.