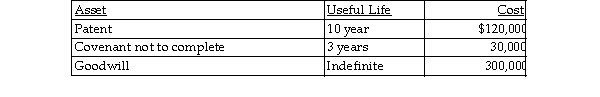

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million. Included in the assets acquired are the following intangible assets:  What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Definitions:

Subcutaneous Injection

A method of administering medication into the fatty tissue just below the skin, allowing for slow, sustained absorption into the bloodstream.

Blood Appears

The emergence or visible presence of blood, potentially indicative of injury, disease, or a medical condition.

Varivax Vaccine

A vaccine used to prevent chickenpox (varicella) infection, typically administered to children and adults who have not had chickenpox.

Ages

Different stages of life or existence, often categorized by years from birth in living organisms or by periods in history for events.

Q57: Identify which of the following statements is

Q66: In general, a noncorporate shareholder that receives

Q82: Matt and Joel are equal partners in

Q93: The Supreme Court has held that literal

Q360: Tyne is single and has AGI of

Q449: A tax bill introduced in the House

Q1098: Yulia has some funds that she wishes

Q1413: Briana, who is single, has taxable income

Q1749: A couple has filed a joint tax

Q2183: Emma, a single taxpayer, obtains permission to