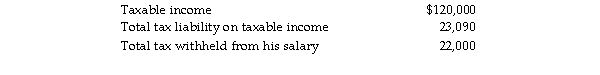

Frederick failed to file his 2018 tax return on a timely basis. In fact, he filed his 2018 income tax return on Octobe 2019, (the due date was April 17, 2019) and paid the amount due at that time. He failed to make timely extension are amounts from his 2018 return:  Frederick sent a check for $1,090 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2018. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,090 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2018. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Verbal Communication

Communication that uses words; may be either oral or written.

Business Etiquette

Business etiquette encompasses the manners and conduct expected within professional settings, guiding interactions and communications.

Team Meeting

A gathering of members of a team to discuss project progress, solve problems, or plan future actions.

Active Listening

The practice of paying full attention, understanding, responding, and then remembering what is being said.

Q26: Identify which of the following statements is

Q32: Lake City Corporation owns all of the

Q39: Tronco Inc. placed in service a truck

Q80: Briefly explain the aggregate and entity theories

Q82: Matt and Joel are equal partners in

Q1096: Rondo Construction, a calendar- year taxpayer, starts

Q1473: On May 1 of this year, Ingrid

Q1597: Lana owned a house used as a

Q2041: Connors Corporation sold a warehouse during the

Q2048: Alvin, a practicing attorney who also owns