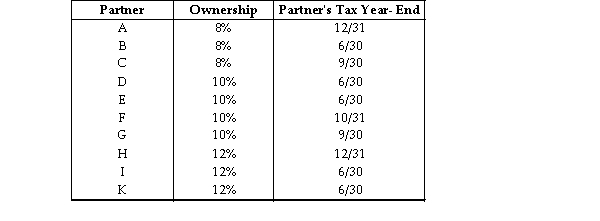

The XYZ Partnership is held by ten partners who have the following capital and profits ownership of the partnership. The tax year- end used by each of the ten partners is also indicated. Assume each partner has used this year- end for at least five years.  What is the required year- end for the XYZ Partnership, assuming that the business has no natural business year and has not filed a Sec. 444 election?

What is the required year- end for the XYZ Partnership, assuming that the business has no natural business year and has not filed a Sec. 444 election?

Definitions:

Conjunctive Task Solutions

Solutions to problems that require the coordination and collective effort of all group members, where the performance of the group is determined by its weakest link.

Steiner's Law

A principle in social psychology that outlines how group productivity is determined by the sum of individual members' contributions, subject to the effects of coordination and motivation.

Group Productivity

Denotes the collective output or accomplishment of a group, often measured in terms of quantity, quality, and efficiency of work produced.

Faulty Process

A procedure or operation that is flawed or dysfunctional, often leading to errors or failures in achieving its intended outcome.

Q11: Town Corporation acquires all of the stock

Q14: Identify which of the following statements is

Q52: The stock of Cooper Corporation is 70%

Q71: The election to file a consolidated return

Q89: What are the consequences of a stock

Q417: Vector Inc.'s office building burns down on

Q1620: The installment method may be used for

Q2045: An improper election to use a fiscal

Q2046: Dean exchanges a business storage facility with

Q2171: Glen owns a building that is used