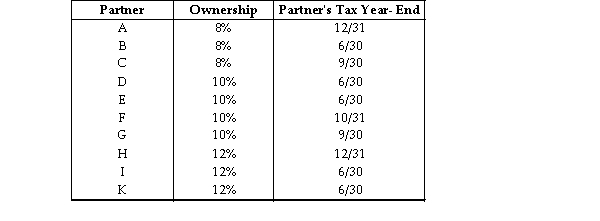

The XYZ Partnership is held by ten partners who have the following capital and profits ownership of the partnership. The tax year- end used by each of the ten partners is also indicated. Assume each partner has used this year- end for at least five years.  What is the required year- end for the XYZ Partnership, assuming that the business has no natural business year and has not filed a Sec. 444 election?

What is the required year- end for the XYZ Partnership, assuming that the business has no natural business year and has not filed a Sec. 444 election?

Definitions:

Confidence Intervals

An interval of values, sourced from statistical analyses of a sample, that is conjectured to include the value of a mysterious population parameter.

Binomial Distribution

A probability distribution that summarizes the likelihood that a value will take one of two independent states under a given number of trials.

Sampling Distribution

Sampling Distribution is the probability distribution of a given statistic based on a random sample, used to make inferences about a population.

Sample Proportion

The ratio of members in a sample exhibiting a certain trait to the total number of members in the sample.

Q21: Identify which of the following statements is

Q36: Define intercompany transactions and explain the two

Q49: Omega Corporation is formed in 2006. Its

Q52: Edward owns a 70% interest in the

Q73: How is the gain/loss calculated if a

Q111: In 2010, Tru Corporation deducted $5,000 of

Q481: All of the following are considered related

Q1175: If the business use of listed property

Q1321: A taxpayer receives permission for a voluntary

Q1474: Tonya sold publicly traded stock with an