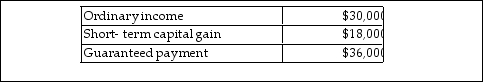

Brent is a general partner in BC Partnership. His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self- employment income?

What is his self- employment income?

Definitions:

Lease Option

A contract that permits a party to lease real property while holding an option to purchase that property.

Real Property

Land and anything permanently attached to it, such as buildings and structures, considered immovable.

Option Contract

A contract granting the option holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time period.

Legal Consideration

Something of value that is promised in exchange for performing an act or refraining from acting, forming a necessary element of a valid contract.

Q28: Which of the following corporations is an

Q35: Blair and Cannon Corporations are members of

Q61: At the beginning of the current year,

Q87: Why would an acquiring corporation want an

Q100: Yee manages Huang real estate, a partnership

Q101: Peach Corporation was formed four years ago.

Q518: The taxpayer must be occupying the residence

Q813: In August 2018, Tianshu acquires and places

Q961: Generally, a full exclusion of gain under

Q1526: Terra Corporation, a calendar- year taxpayer, purchases