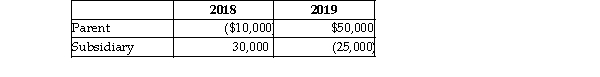

Parent and Subsidiary Corporations form an affiliated group. In 2018, the initial year of operation, P and Subsidiary filed separate returns. In 2019, the group files a consolidated tax return. The results and 2019 are: Taxable Income  How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Total Expenses

The aggregate amount of all costs incurred by a business during a specific period.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity, providing a more useful tool for performance evaluation.

Employee Salaries And Wages

Refers to the total payments made to employees for the work they have done, inclusive of overtime, bonuses, and other compensations.

Flexible Budget

A budget that adjusts or flexes for changes in the volume of activity, providing a more useful tool for performance evaluation than a static budget.

Q20: John Van Kirk owns all the stock

Q26: Richards Corporation has taxable income of $280,000

Q32: Bishop Corporation reports taxable income of $700,000

Q48: Victor and Kristina decide to form VK

Q92: Sun and Moon Corporations each have only

Q259: Under the MACRS system, the same convention

Q1212: On January 3, 2015, John acquired and

Q1718: Gifts made during a taxpayer's lifetime may

Q1992: Generally, the statute of limitations is three

Q2185: On January l, Grace leases and places