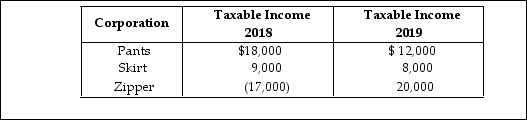

Pants and Skirt Corporations are affiliated and have filed consolidated tax returns for the past three years. Pants acquires 100% of Zipper stock on January 1 of 2019. Zipper Corporation filed separate returns previously. Pants, Skirt, and Zipper filed a consolidated return for 2019 and reported the following taxable incomes:  How much of the 2018 Zipper NOL be used to offset CTI in 2019?

How much of the 2018 Zipper NOL be used to offset CTI in 2019?

Definitions:

Neurons

Specialized cells within the nervous system that transmit information to other nerve cells, muscle, or gland cells, primarily through electrical and chemical signals.

Maculae

Specialized structures in the vestibular system of the inner ear involved in detecting linear acceleration and gravitational forces.

Crista Ampullaris

Elevation on the inner surface of the ampulla of each semicircular duct for dynamic or kinetic equilibrium.

Semicircular Canals

Structures in the inner ear that are key to maintaining balance by detecting head movements.

Q3: New York Corporation adopts a plan of

Q17: Under the MACRS rules, salvage value is

Q39: Identify which of the following statements is

Q73: Green Corporation is incorporated on March 1

Q84: Winter Corporation's taxable income is $500,000. In

Q89: Why should a corporation that is 100%

Q116: The installment sale method may be used

Q1199: All of the following transactions are exempt

Q1457: Which of the following is not a

Q1919: The marginal tax rate is useful in