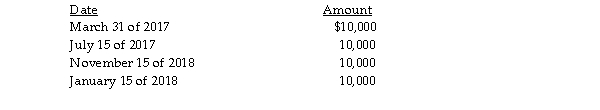

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:  What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

Definitions:

Marginal Product

The increase in output that arises from an additional unit of input, holding all other inputs constant.

Profit-Maximizing Firm

A business entity's objective of adjusting production and sales to achieve the highest possible profit levels.

Wage Rate

The amount of money a worker is paid per unit of time, such as an hour or a month.

Marginal Cost

The cost related to the production of an additional unit of a product or service.

Q35: If a controlling shareholder sells depreciable property

Q37: All of the taxable income of a

Q47: A high tax bracket individual can enhance

Q51: Zebra Corporation transfers assets with a $120,000

Q67: Are liquidation and dissolution the same? Explain

Q67: In accordance with the rules that apply

Q72: Brown Corporation has assets with a $650,000

Q72: Key Corporation distributes a patent with an

Q73: Jersey Corporation purchased 50% of Target Corporation's

Q145: Which of the following is an advantage