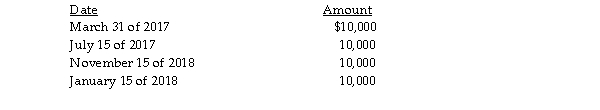

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:  What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

Definitions:

Ending Inventories

The total value of all inventory a company has at the end of its accounting period, including products ready for sale and materials for production.

Income Statement Columns

Sections on an income statement, typically including revenues, expenses, and net income, to display financial performance.

Net Loss

The amount by which expenses exceed revenues, indicating a financial loss for a period.

Net Income

The total profit or loss of a company after all revenues, expenses, taxes, and costs have been subtracted from total income.

Q3: Gee Corporation purchased land from an unrelated

Q10: For a 30% interest in partnership capital,

Q36: Corporations may carry charitable contributions in excess

Q45: Andy owns 20% of North Corporation and

Q73: Green Corporation is incorporated on March 1

Q95: How does the use of a net

Q108: Identify which of the following statements is

Q129: Norman transfers machinery that has a $45,000

Q155: Identify which of the following statements is

Q201: Identify which of the following statements is