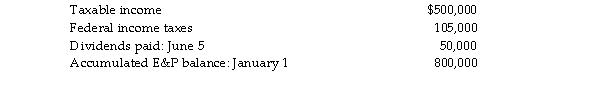

Lawrence Corporation reports the following results during the current year:  No dividends were paid in the throwback period. A long- term capital gain of $50,000 is included in taxable inco The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.

No dividends were paid in the throwback period. A long- term capital gain of $50,000 is included in taxable inco The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.

What is Lawrence Corporation's accumulated earnings tax liability?

Definitions:

Equipment Shortages

Situations wherein the demand for specific equipment exceeds the available supply, often leading to operational delays and increased costs.

Intermodal Shipments

The transportation of goods using more than one mode of transport, such as trucks, trains, and ships, to improve efficiency and reduce costs.

Freight Documentation

The collection of documents required for the transportation of goods over distances, encompassing details like shipping orders, invoices, and bills of lading.

Q13: In computing the ordinary income of a

Q27: An individual shareholder owns 3,000 shares of

Q40: Identify which of the following statements is

Q56: The treatment of capital loss carrybacks and

Q84: Jerry purchased land from Winter Harbor Corporation,

Q101: Peach Corporation was formed four years ago.

Q107: Ali, a contractor, builds an office building

Q132: Darlene, a U.S. citizen, has foreign- earned

Q138: Identify which of the following statements is

Q1375: The Senate equivalent of the House Ways