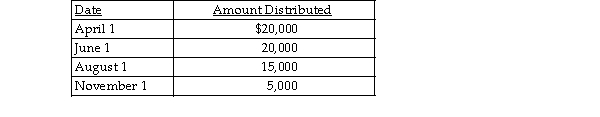

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $4,000 is taxable as a dividend from accumulated E&P, and $11,000 is tax- free as a return of capital.

C) $15,000 is taxable as a dividend from accumulated E&P.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax- free as a return of capital.

Definitions:

Corporate Theft

Corporate theft refers to the illegal taking of a company's assets, either by individuals within the organization or by external parties, for personal gain.

Extinction Procedure

A behavioral psychology technique involving the discontinuation of reinforcements for a certain behavior, leading to its reduction or elimination.

Reinforced

Strengthened or made more effective through added support, material, or structure.

Eliminated

Refers to the removal or deletion of something, making it no longer present or effective.

Q4: Identify which of the following statements is

Q7: Julia, an accrual- method taxpayer, is a

Q24: What are the differences between a controlled

Q53: Marietta and Alpharetta Corporation, two accrual method

Q55: What is probably the most common reason

Q56: Identify which of the following statements is

Q68: Identify which of the following statements is

Q91: What is a corporate inversion and why

Q93: The maximum failure to file penalty is

Q162: Which of the following statements about a