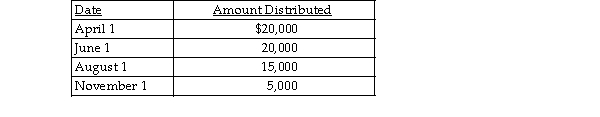

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $4,000 is taxable as a dividend from accumulated E&P, and $11,000 is tax- free as a return of capital.

C) $15,000 is taxable as a dividend from accumulated E&P.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax- free as a return of capital.

Definitions:

Charity Fairs

Public or private gatherings organized to raise funds and awareness for charitable causes, often featuring goods for sale, games, and entertainment.

Tracts

Short written works, usually on religious or political topics, intended for wide distribution and often used to disseminate or support specific viewpoints.

Speaking Tours

Events or series of events where individuals travel to various locations to give speeches, often to spread information or advocate for causes.

Q24: What are the differences between a controlled

Q60: Intercompany dividends and undistributed subsidiary earnings do

Q65: What are the advantages and disadvantages of

Q71: Crossroads Corporation distributes $60,000 to its sole

Q88: For purposes of determining current E&P, which

Q96: Identify which of the following statements is

Q100: Identify which of the following statements is

Q101: Rashad contributes a machine having a basis

Q104: How does the use of an NOL

Q139: Phil and Nick form Philnick Corporation. Phil