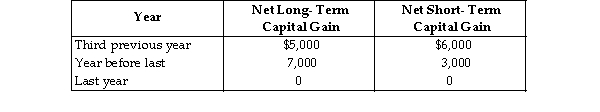

Lass Corporation reports a $25,000 net capital loss this year. The corporation reports the following net capital gains during the past three years.  Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, i available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, i available as a carryforward.

Definitions:

Secondary Territory

Area, such as the desk you usually sit at, that you don’t really own but nonetheless consider to be “yours.”

English Class

An English class is an academic course focused on the study and application of the English language, including grammar, literature, writing, and reading comprehension.

Public Library

A community institution that provides access to a wide range of information resources, including books, digital media, and educational programs, free of charge.

Public Territories

Public territories refer to areas that are open and accessible to anyone, such as parks, streets, and public squares, where individuals can interact freely.

Q14: Identify which of the following statements is

Q26: Richards Corporation has taxable income of $280,000

Q29: When gain is realized by a target

Q30: Identify which of the following statements is

Q32: In the current year, Ho Corporation sells

Q48: When appreciated property is distributed in a

Q62: In January of the current year, Rae

Q80: A U.S. citizen, who uses a calendar

Q83: Good Times Corporation has a $60,000 accumulated

Q90: A trust has distributable net income (DNI)