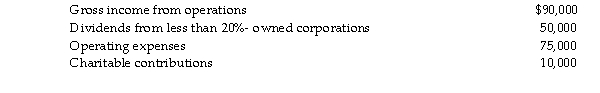

Dexter Corporation reports the following results for the current year:  In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income fo current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income fo current year?

Definitions:

Adjusting Entry

An accounting entry made to correct, update, or complete financial records at the end of an accounting period.

Net Income

The total amount of profit earned by a company after all expenses and taxes have been deducted from total revenue.

Depreciation Expense

An accounting method used to allocate the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Accrued Expense

An accounting term for expenses that have been incurred but not yet paid, representing a company's obligation to make future payments.

Q1: Last year, Trix Corporation acquired 100% of

Q7: Marge died on August 24 of the

Q33: Under the general liquidation rules, Kansas Corporation

Q43: Paper Corporation adopts a plan of reorganization

Q49: Omega Corporation is formed in 2006. Its

Q55: Which of the following items can be

Q80: A U.S. citizen, who uses a calendar

Q82: Identify which of the following statements is

Q113: Joshua owns 100% of Steeler Corporation's stock.

Q152: On July 9, 2008, Tom purchased a