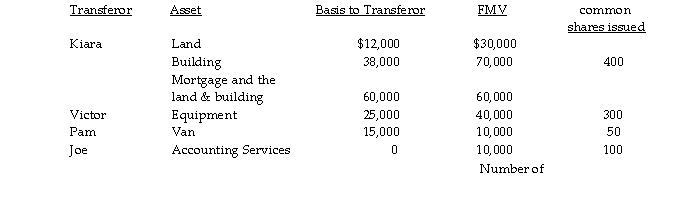

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investme

Property Transferred  Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight- line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in thre The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,00 also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight- line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in thre The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,00 also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a) Does the transaction satisfy the requirements of Sec. 351?

b) What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c) What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock beg

d) What is Newco Corporation's basis for its property and services? When does its holding period begin for eac property?

Definitions:

Customizing

The process of modifying or creating products or services according to the customer's or user's specific needs.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead to products or job orders based on a certain activity base.

Machine-Hours

A measure of the amount of time a machine is operated within a specific period, often used for allocating machine costs to products.

Direct Labor-Hours

Total labor hours of workers directly engaged in the production line.

Q17: Discuss the ways in which the estate

Q28: Identify which of the following statements is

Q28: Treasury Department Circular 230 regulates the practice

Q40: Bat Corporation distributes stock rights with a

Q71: Parent Corporation owns 100% of the stock

Q90: Identify which of the following statements is

Q91: Sasha gives $1,000,000 to her granddaughter. Sasha

Q93: The Supreme Court has held that literal

Q96: Identify which of the following statements is

Q97: Following are the fair market values of