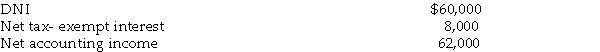

A simple trust has the following results:  Calculate the distribution deduction.

Calculate the distribution deduction.

Definitions:

Marginal Product

The additional output generated by employing one more unit of input.

Production Functions

Mathematical representations of the relationship between a firm's inputs and its outputs.

U.S. Immigrants

People who have moved to the United States from another country to live permanently.

Real Wage Rates

The purchasing power of wages, adjusted for inflation, indicating the quantity of goods and services wages can buy.

Q27: Robert Elk paid $100,000 for all of

Q48: Identify which of the following statements is

Q60: The STU Partnership, an electing Large Partnership,

Q60: A complex trust permits accumulation of current

Q68: Edison Corporation is organized on July 31.

Q69: Quality Corporation, a regular corporation, has an

Q77: NOLs arising in tax years ending after

Q106: Identify which of the following statements is

Q169: A foreign corporation with a single class

Q187: Identify which of the following statements is