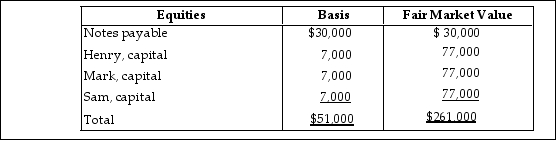

The HMS Partnership, a cash method of accounting entity, has the following balance sheet at December 31 of last year:

Sam, who has a one- third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for

$77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities) at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Superior Mesenteric Vein

A large vein in the abdomen that drains blood from the small intestine, part of the large intestine, and other organs in the digestive system into the portal vein.

Gastrosplenic Vein

A blood vessel that drains blood from the stomach and spleen, typically emptying into the portal vein system.

Ulnar Veins

Veins located along the ulnar side of the arm that help return deoxygenated blood from the hand and forearm to the heart.

Radial Vein

A vein that runs along the radial side of the forearm, draining blood from the hand and arm back toward the heart.

Q2: A strategy consists of buying a market

Q6: Using a binomial tree, what is the

Q6: Ward and June decide to divorce after

Q12: The prices of 1, 2, 3, and

Q18: King Corporation, an electing S corporation, is

Q22: Assume corn spot prices over the next

Q22: A company issues an option grant with

Q38: Jennifer and Terry, a married couple, live

Q78: Identify which of the following statements is

Q100: Cactus Corporation, an S Corporation, had accumulated